At $26,000 per Employee, Thousands at Stake

By David King

There are several government programs to help business recover from the strain of Covid-19 pandemic economic shut down. One such program is the Employee Retention Credit (ERC) program. This is a tax credit designed to bolster those businesses that were able to retain employees during this period.

Due to the extremely complex tax code and qualifications, it is severely underutilized. However, it would be well worth the effort to see if your business qualifies for this generous stimulus program. In some cases, it may result in a surprising windfall. The program is taken according to payroll taxes paid and not on income taxes. This means that ERC funds not applied towards owed payroll taxes are treated as an ‘over deposit’ of taxes that you will need to request as a refund check from the IRS.

While an accountant can do this work, CPAs generally do not do payroll.

Payroll companies could also be an option, but they tend to not be pro-active about it. We spoke to an ERC trained specialist at one of the largest payroll companies, Paychex. While they do have a department prepared to process such claims, clients need to come forward and request the service. According to them, it is not something they reach out to their clients to discuss.

There are companies that specialize in this service for a fee and have made it as painless an IRS filing can be. Fees may vary between such companies, but most earn after you have received your refund. Some will offer a discounted fee for advance payment. Fees range from 10% of credit in advanced to 15% for full fee at time of credit.

We asked about the advance fee policy with, Silvio Dobrovat of Concord, an affiliate of ERC Specialists, “If for any reason IRS does not release the credit claimed, ERC Specialists guarantees a full refund of any advance payment.” This is also explained on a local affiliate website. www.ERCspecialists.us.

This is not a lending program. Tax refunds are issued by the US Treasury. Therefore, all eligible employers will receive the funds due and properly claimed. You will need to be patient to receive your money. IRS documentation says the refund can take as much as 20 weeks.

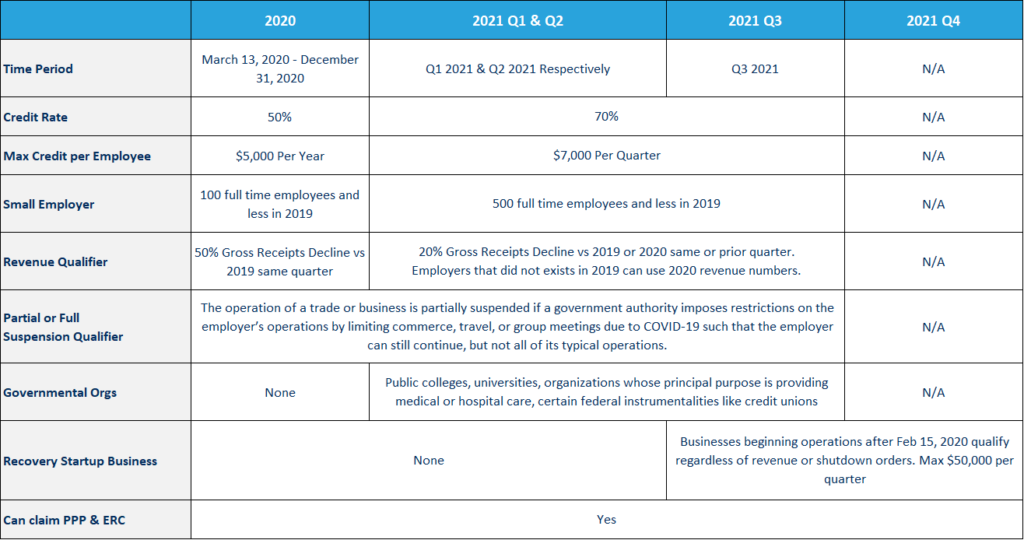

While the general qualifications for the ERC program seem simple, the interpretation of each qualification is complex. Specifically, the program addresses the period from 2020 through 3rd quarter of 2021. The program will credit up to $26,000 per employee for businesses up to 500 employees that meet some important qualifications. Here are the basics.

Did your business experience a full or partial suspension of business operations? Had a government authority required partial or full shutdown of your business during 2020 or 2021. This includes your operations being limited by commerce, inability to travel, or restrictions of group meetings. Or did you experience gross receipts reduction within the stated period? Gross receipt reduction criteria are different for 2020 and 2021 but are measured against the current quarter as compared to 2019 pre-COVID amounts.

The complexity of the program is explained on ERC specialists’ website in simple terminology. However, they also offer a link to the IRS page if you prefer to read actual tax code language.

“Businesses need to go through the process. One local tree service here in Concord qualified for more than a $250,000 credit! He absolutely was completely surprised,” Dobrovat says.

Most employers, including colleges, universities, hospitals and 501(c) organizations could qualify for the credit. Previously, the Consolidated Appropriations Act expanded qualifications to include businesses who took a loan under the Paycheck Protection Program (PPP), including borrowers from the initial round of PPP who originally were ineligible to claim the tax credit. The credit can only be taken on wages that are not forgiven or expected to be forgiven under PPP.

This can be delineated once you fill out the qualification forms, which you can do online. You will need your payroll tax records to complete the form. You can determine a preliminary estimate by simply looking at your payroll taxes paid for all qualifying wages for the six quarters for each of your employees Q1 2020 to Q3 2021.

The Summary Table graphic can help be a road map to determining the credit you can claim as rules changed over this period. Businesses have until 2024 to do a look back on their payroll during the pandemic and retroactively claim the credit by filing an amended tax return, but with a looming recession most businesses need the credit much sooner.